Attention all service members! The IRS has just confirmed that the special $1,776 payment you received in December 2025 is completely tax-free and does not need to be reported as income on your 2026 tax return. This crucial update means you get to keep the full amount without any federal tax withholding, providing significant financial relief during tax season.

Approximately 1.45 million military personnel received this “Warrior Dividend” payment as part of the historic legislation signed in July 2025. The IRS’s clarification ends any confusion about how to handle this money when filing taxes this year. Here’s your complete guide to understanding why it’s tax-free and how to ensure you file your taxes correctly.

What is the $1776 Tax-Free Military Payment?

This was a one-time payment authorized to supplement basic housing allowances for service members. Here are the key facts:

| Aspect | Detail |

|---|---|

| Payment Amount | $1,776 (Symbolic of the year 1776) |

| Official Name | “Warrior Dividend” |

| Authorization | One, Big, Beautiful Bill (July 2025) |

| Total Funding | $2.9 Billion appropriated |

| Tax Status | 100% Tax-Free (IRS confirmed) |

The payment was designed as a “qualified military benefit” under federal law, which excludes it from gross income calculations.

Who Received the $1776 Military Payment Tax-Free?

The $1776 Military Payment was distributed to eligible active-duty service members who met specific criteria. Here’s who qualified:

- Active Duty Service Members across all branches of the U.S. military

- Members who were serving as of the authorization date in July 2025

- Approximately 1.45 million personnel who received payments in December 2025

- Personnel eligible for basic housing allowance supplements

Why is the $1,776 Payment Tax-Free?

The IRS clarified this payment falls under special tax exemptions for military benefits. Here are the key reasons:

- Qualified Military Benefit: Classified as a supplemental housing allowance under military compensation rules.

- Federal Law Exclusion: Specifically excluded from gross income under Internal Revenue Code provisions.

- Congressional Intent: The legislation designated it as a non-taxable benefit rather than regular income.

- Historical Precedent: Similar to other tax-exempt military allowances like combat pay exclusions.

- IRS Ruling: Formal confirmation that no Form 1099 will be issued for this payment.

How Should You Report This on Your 2026 Tax Return?

This is the most important information for filing your taxes correctly this year. Follow these steps:

- Do NOT report it as income: The $1,776 should not appear on your Form 1040 as taxable income.

- No 1099 Form: You will not receive a 1099 form for this payment from the Defense Department.

- Keep your records: Maintain proof of payment (bank statement or DFAS statement) for your records.

- Consult with tax preparer: If using a tax service, inform them this payment is tax-exempt.

- State taxes may vary: While federally tax-free, check your state’s rules as some states might treat it differently.

Official IRS Guidance: For verification, service members can refer to the $1776 Military Payment Tax Guide or visit the official IRS website: https://www.irs.gov/military

What Documents Should You Have Ready?

When preparing your taxes, ensure you have these documents that show the payment was received:

- December 2025 LES (Leave and Earnings Statement): Should show the $1,776 payment.

- Bank Statements: Deposit records showing the $1,776 transaction.

- MyPay Documentation: Screenshots or printouts from the Defense Finance system.

- Payment Confirmation: Any official email or notification from your command or finance office.

Common Questions About the Tax-Free $1776 Military Payment

Service members are asking these important questions about the payment:

- Will this affect my tax bracket? No, since it’s not counted as income, it won’t push you into a higher tax bracket.

- Do reservists and National Guard qualify? The payment was primarily for active-duty members, but check with your finance office for specific eligibility.

- What if I didn’t receive the payment? Contact your unit’s finance office or DFAS immediately to check your eligibility status.

- Is this payment recurring? This was a one-time payment authorized for 2025, not an ongoing allowance.

- Does this affect my housing allowance? No, it was a supplemental payment that doesn’t change your regular BAH calculations.

What Other Military Benefits Are Tax-Free?

Understanding what’s tax-free can help with financial planning. Common tax-exempt military benefits include:

- Combat Zone Pay: All enlisted and warrant officer pay is tax-free in combat zones.

- Basic Allowance for Housing (BAH): Not taxable when used for housing expenses.

- Basic Allowance for Subsistence (BAS): Non-taxable food allowance.

- Moving Allowances: Most PCS relocation benefits are tax-free.

- Death Gratuity Payments: Paid to survivors of deceased service members.

Important Deadlines and Next Steps

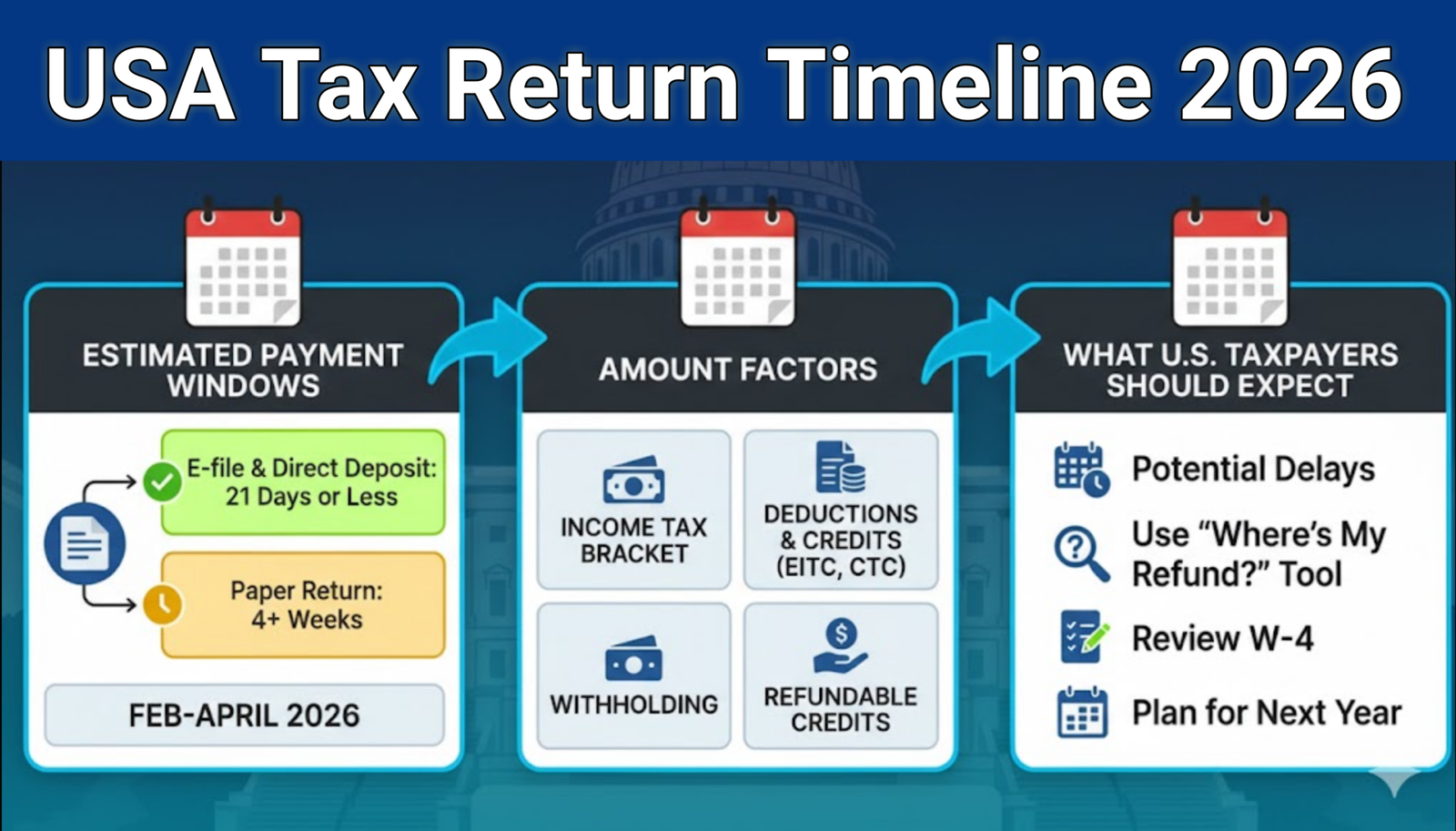

As you prepare your 2026 tax return (for income earned in 2025), remember these key points:

- Tax Filing Deadline: April 15, 2026 (or October 15 with extension)

- Free Military Tax Help: Available through Military OneSource and VITA programs

- State Filing Requirements: Check if your state requires reporting of this payment

- Record Keeping: Keep all payment documentation for at least 3 years after filing

In summary, the $1776 Military Payment “Warrior Dividend” is yours to keep in full. When filing your 2026 taxes, do not include this amount as taxable income. Always verify with your finance office or a qualified military tax advisor if you have specific questions about your situation. This tax-free status represents significant savings and recognition of your service to the nation.