The news about $2000 direct deposits start 9 February 2026 is spreading fast, and many people are searching daily to know when their IRS tax refund will arrive. If you filed your 2025 tax return early and selected direct deposit, this update is especially important for you. In simple words, early filers are first in line. The IRS has already started processing returns, and the first batch of refunds is expected to reach bank accounts in the second week of February.

This article explains the IRS tax refund schedule 2026, expected dates, reasons for delays, and how you can track your money easily.

Read More: IRS Tax Filing Dates

Table of Contents

IRS Tax Refund 2026 – Quick Overview

| Refund Topic | Details |

| Main Keyword | $2,000 Direct Deposits Start 9 February 2026 |

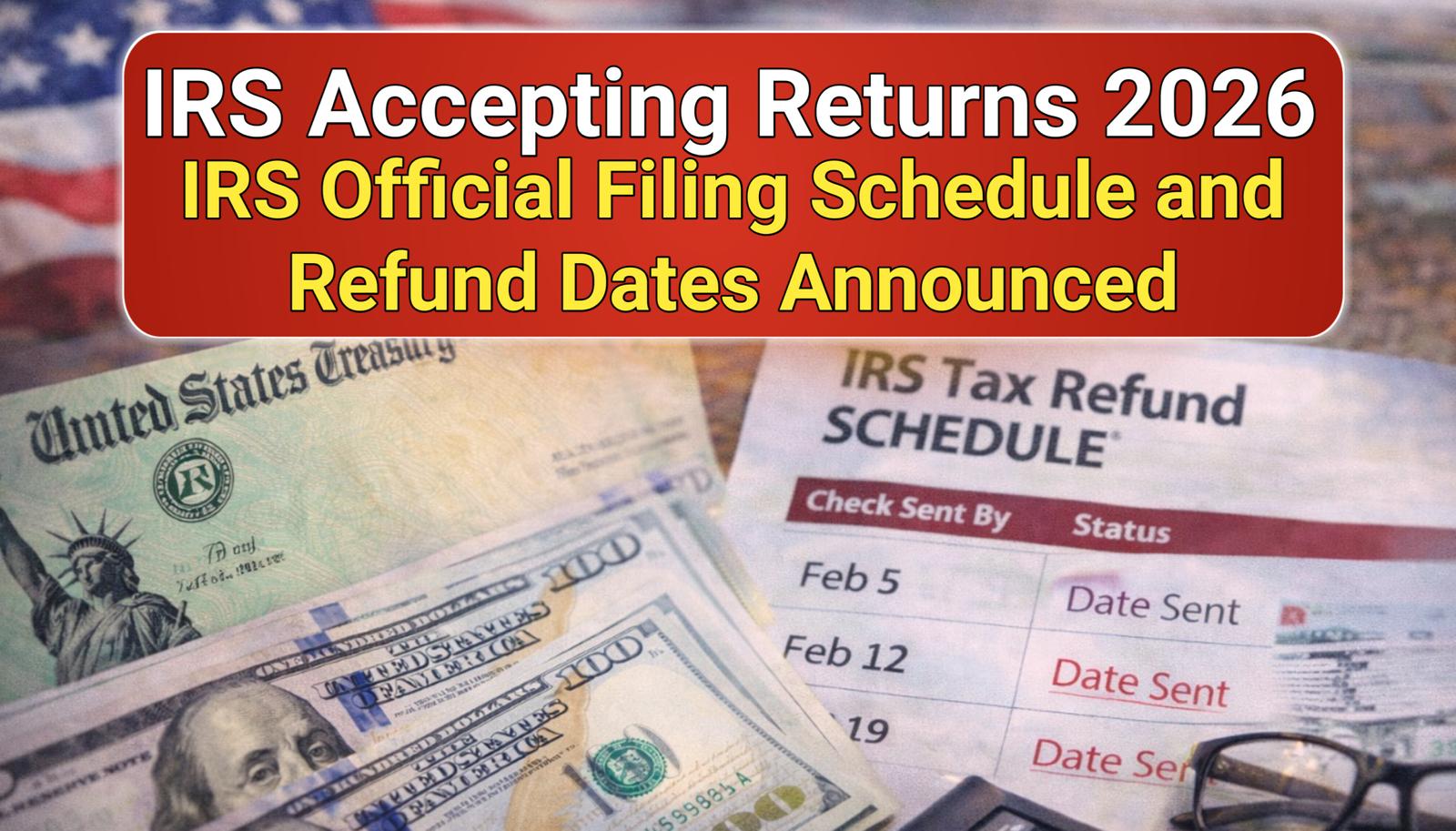

| Filing Season Started | 26 January 2026 |

| Expected First Refunds | From 9 February 2026 |

| Fastest Method | E-file + Direct Deposit |

| Average Refund Amount | $2,000 – $4,000 |

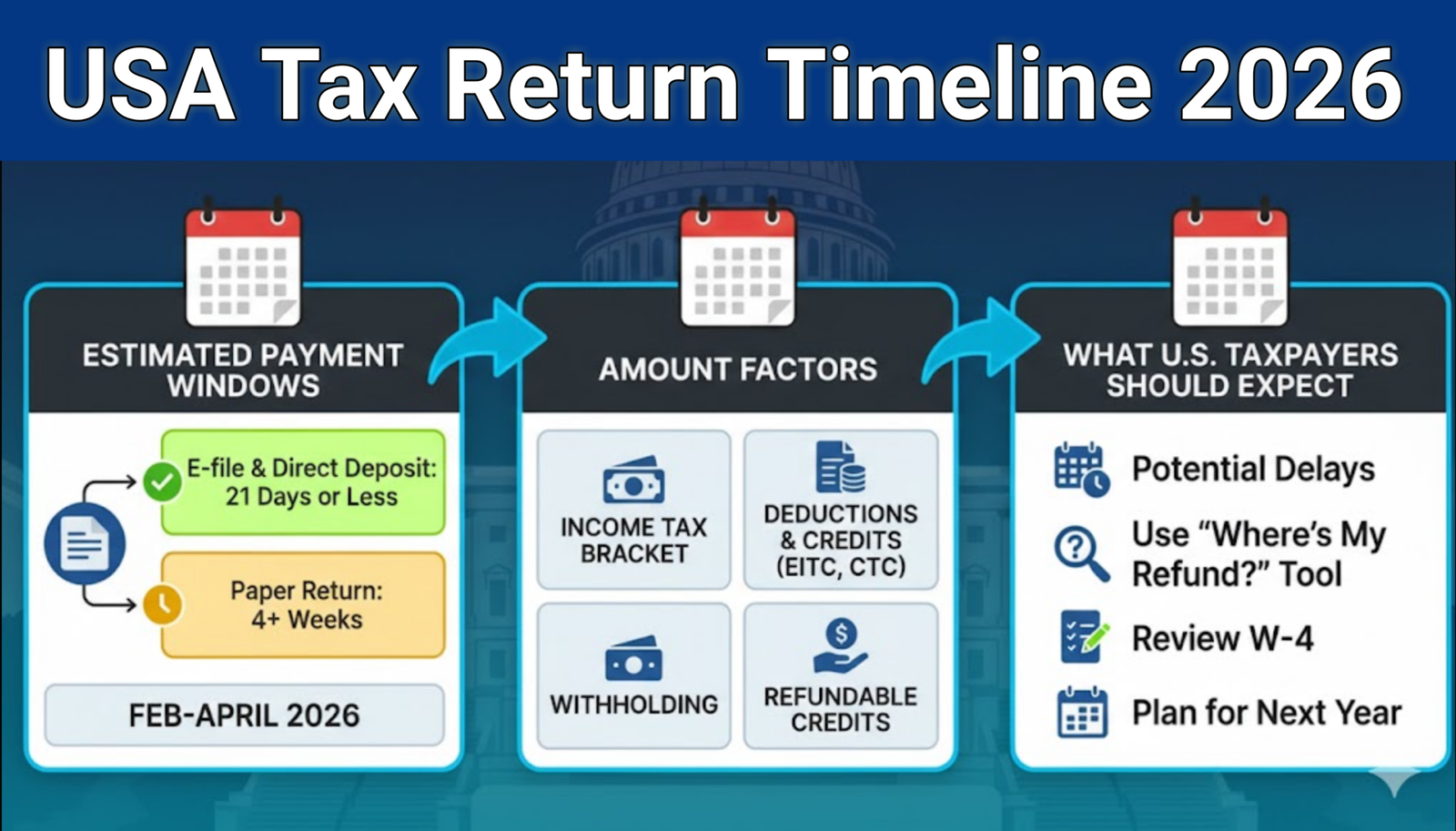

| Normal Processing Time | Up to 21 days |

| Official Tracking Tool | Where’s My Refund? |

How the 2026 IRS Tax Refund Season Is Beginning

The Internal Revenue Service (IRS) officially started accepting and processing tax returns on January 26, 2026. This marks the beginning of a busy season where over 160 million individuals are expected to file. According to information from the Official IRS Website and top 10 Google sources, the agency has improved its digital systems to handle returns faster this year. Early birds who did their paperwork in January are the ones likely to see the $2,000 direct deposits by early February.

Read More: UK Dependant Visa Rules

Why 9 February 2026 Is Important for IRS Refunds

Many taxpayers are asking why 9 February 2026 keeps coming up again and again. The reason is simple. The IRS usually takes around 21 days to process electronically filed tax returns. People who filed on the first few days after 26 January 2026 are now reaching that timeline.

Every year, the IRS releases refunds in batches. The first big batch normally hits in early to mid-February. That is why this date matters so much, especially for those who filed early with correct information.

Who Will Get the $2,000 Direct Deposit First?

Not everyone will receive their refund on the same day. The IRS follows a system. You may receive your money earlier if:

- You filed your tax return electronically

- You chose direct deposit instead of a paper check

- Your return is simple with no major errors

- You did not claim restricted tax credits

People who meet these conditions are usually the first to see their $2,000 IRS refund.

Reasons Your IRS Refund May Be Delayed

Sometimes, even early filers face delays. This does not always mean something is wrong. Here are common reasons:

- Earned Income Tax Credit (EITC) – By law, refunds with EITC cannot be released before mid-February.

- Additional Child Tax Credit (ACTC) – These refunds also face the same legal delay.

- Identity Verification – The IRS may ask you to verify your identity for security reasons.

- Paper Filing – Mailed returns take much longer than online filing.

- Bank Processing Time – Some banks show the deposit one or two days late.

How to Check IRS Refund Status Online

Checking your refund status is very easy and takes only two minutes.

- Visit the official IRS website or open the IRS2Go app

- Click on Where’s My Refund?

- Enter your Social Security Number or ITIN

- Select your filing status

- Enter the exact refund amount

You will see one of these statuses: Return Received, Refund Approved, or Refund Sent.

Read More: U.S. Olympic gold medalist

Documents You Must Have Before Filing

Missing or incorrect documents can slow everything down. Always double-check these items:

- W-2 forms from employers

- 1099 forms for freelance or extra income

- Correct bank account and routing number

- Last year’s tax return (for AGI verification)

Having the right documents helps avoid delays and ensures your refund reaches you on time.

Direct Deposit vs Paper Check – What’s Better?

| Direct Deposit | Paper Check |

| Faster payment | Takes weeks longer |

| More secure | Can be lost or stolen |

| No mailing issues | Depends on postal service |

| Recommended by IRS | Not advised unless necessary |

Direct deposit is clearly the better choice if you want your money quickly and safely.

IRS Contact Details for Refund Help

If more than 21 days have passed and there is no update, you can contact the IRS:

- IRS Helpline: 1-800-829-1040

- Refund Hotline: 1-800-829-1954

- Appointment Line: 1-844-545-5640

Call during off-peak hours to avoid long waiting times.

Final Thoughts

The update of about $2000 direct deposits start 9 February 2026 has brought relief to many families. If you filed early and used direct deposit, your refund may arrive very soon. Keep checking the official IRS refund tool instead of relying on rumors. Even if your money does not arrive on the exact date, it will be sent in the coming days.

Read More: Social Security Payment Boost

FAQs

Q: Is the $2,000 a new stimulus check?

No. This is a regular IRS tax refund, not a new stimulus payment.

Q: Why did someone else get their refund earlier than me?

Each tax return is processed separately. Simple returns are completed faster.

Q: Can I change my bank details after filing?

No. Once accepted, bank details cannot be changed.

Q: What does “Refund Still Being Processed” mean?

It means the IRS is still reviewing your return. It is usually normal.